Korea Hydrogen Industry Value Chain 2025

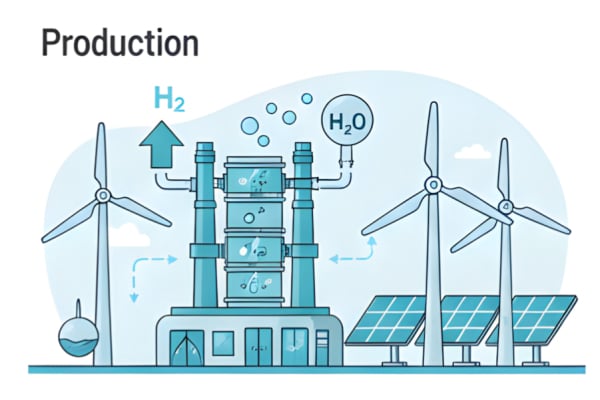

1. Hydrogen Production: Establishing a 5 Million Ton System by 2050

1.1 Grey, Blue, and Green Hydrogen Production Strategy• Status and Expansion of By-product HydrogenPOSCO currently produces 7,000 tons of by-product hydrogen annually from the steelmaking process and plans to expand this to 70,000 tons by 2025. Hyundai Oilbank possesses a maximum annual production capacity of 300,000 tons of petrochemical by-product hydrogen, currently producing 220,000 tons. The SK E&S Incheon Liquid Hydrogen Plant has established a model to refine by-product hydrogen from SK Incheon Petrochem to produce 30,000 tons of liquid hydrogen annually.

• Full-scale Blue Hydrogen ProjectsSK E&S is constructing a blue hydrogen production plant near the Boryeong LNG Terminal with a target of 250,000 tons annually. By combining natural gas reforming with CCS (Carbon Capture and Storage) technology, it aims to build a large-scale blue hydrogen supply system by 2030. POSCO plans to complete a 500,000-ton blue hydrogen production system by 2030 in cooperation with global companies.

• Long-term Green Hydrogen StrategyPOSCO aims for a hydrogen production system of 2 million tons by 2040 and 5 million tons by 2050, promoting renewable energy-based green hydrogen projects. It participated in the Oman project in 2023 and signed an MOU with Orsted of Denmark for offshore wind-linked green hydrogen production. Lotte Group is pursuing the H2biscus Project (150,000 tons of green hydrogen, 850,000 tons of green ammonia annually) based on hydropower in Sarawak, Malaysia.

1.2 Water Electrolysis Technology Development StatusHyundai Motor Group is developing megawatt-class PEM water electrolysis devices and promoting price competitiveness through fuel cell component commonization. Hanwha Solutions is researching ways to lower power consumption and initial investment compared to existing methods by developing Anion Exchange Membrane Water Electrolysis (AEMWE) technology. The government has been fully supporting the construction of water electrolysis hydrogen production bases and blue hydrogen production bases since 2024.

Currently, the SMR (Steam Methane Reforming) method is the cheapest in terms of production cost per kg, but water electrolysis green hydrogen is expected to secure economic feasibility after 2040 due to the drop in renewable energy generation costs. The government has set a hydrogen price target of KRW 3,000 per kg by 2040.

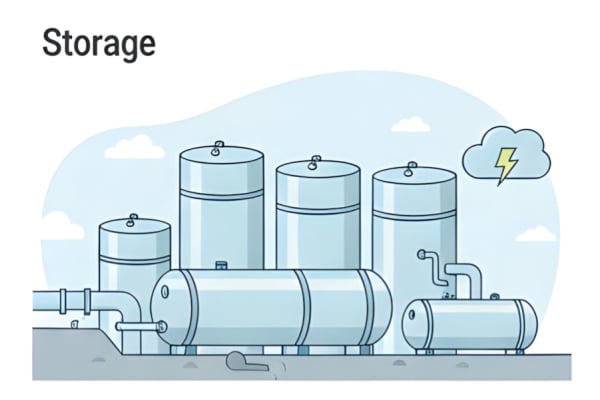

2. Hydrogen Storage and Transportation: World's Largest Liquid Hydrogen Infrastructure

2.1 Leading Liquid Hydrogen Plants• SK E&S Incheon Liquid Hydrogen PlantIt is the world's largest single liquid hydrogen plant that began commercial operation in March 2024. It has an annual production capacity of 30,000 tons and liquefies hydrogen at a cryogenic temperature of -253°C to reduce its volume to 1/800. With a total investment of KRW 500 billion, this volume is enough to operate 5,000 hydrogen buses for a year. SK E&S is promoting the construction of 40 liquid hydrogen charging stations nationwide.

• Hyosung Heavy Industries Ulsan PlantHyosung Heavy Industries, in a joint venture with Linde, is constructing a liquid hydrogen plant in Ulsan with a phase 1 capacity of 13,000 tons per year (expanding to 39,000 tons in the future). Linde Hydrogen (production) and Hyosung Hydrogen (sales) share roles, with plans to build liquid hydrogen infrastructure at about 120 locations nationwide.

2.2 Diversification of Hydrogen Storage Technology

• High-Pressure Gas Storage (Type IV Tank)Iljin Hysolus possesses Type IV tank manufacturing technology, which only two companies in the world, including Toyota, can produce. Vehicle tanks storing 2.1kg at 700bar pressure are exclusively supplied to Hyundai Motor's Nexo, with over 100,000 units already on the road. The Type IV tank for 450bar tube trailers stores 500kg, boasting 1.5 times higher transport efficiency than existing Type I tanks.

• Liquid Hydrogen Storage TankCrios developed a 1-ton liquid hydrogen storage tank as a national project, and its 4-ton storage tank boasts world-class insulation performance with a natural boil-off rate of 0.2%, four times superior to the industry average of 0.9%. D-Al developed the world's largest capacity 3-ton liquid hydrogen tank trailer, with a single transport volume equivalent to 12 trips of a gas hydrogen tube trailer.

• Metal HydrideHydrolux achieved a hydrogen storage capacity of 3.3wt% with Mg-based hybrid metal hydride. Operating at room temperature and low pressure of 10-40bar, it does not require high pressure and has excellent safety. It is applied to hydrogen scooters and forklifts and won an award at CES 2024.

• Underground Rock Cavern StorageThe Korea Institute of Geoscience and Mineral Resources (KIGAM) is researching rock cavern hydrogen storage technology utilizing Korea's granite terrain. They are developing ways to apply LNG underground storage experience (boil-off rate 0.01%/day) to hydrogen by designing steel pipe or cavern-type cavities at depths of tens to hundreds of meters underground. The Korea Institute of Civil Engineering and Building Technology is conducting research on underground space utilization with the goal of demonstrating an urban hydrogen supply base by 2026.

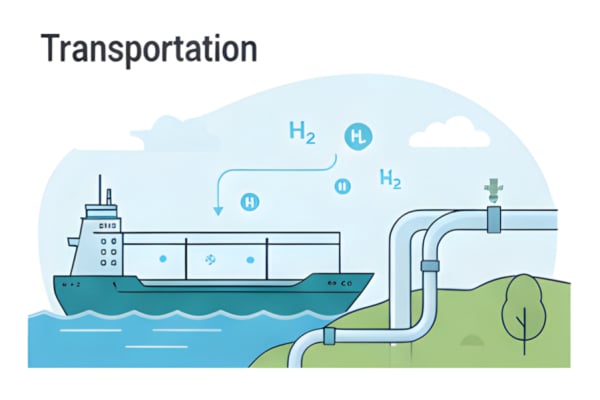

2.3 Innovation in Hydrogen Transport Infrastructure• Liquid Hydrogen CarrierHD Korea Shipbuilding & Offshore Engineering is developing technology with the goal of commercializing large liquid hydrogen carriers by 2030. The government, together with three Korean shipbuilders, is pursuing a roadmap to develop commercial liquid hydrogen carriers: a 2,000㎥ demonstration vessel by 2027, 40,000㎥ by 2032, and 160,000㎥ by 2040. Samsung Heavy Industries has obtained international certification for 20,000㎥ and 80,000㎥ designs.

• Ammonia CarrierHD Korea Shipbuilding & Offshore Engineering signed a contract for the world's first medium-sized ammonia DF (Dual Fuel) propulsion ship in March 2023, with delivery scheduled for 2025. It has since secured orders for a total of about 10 ships, establishing itself as a key means of reducing carbon emissions by over 90%.

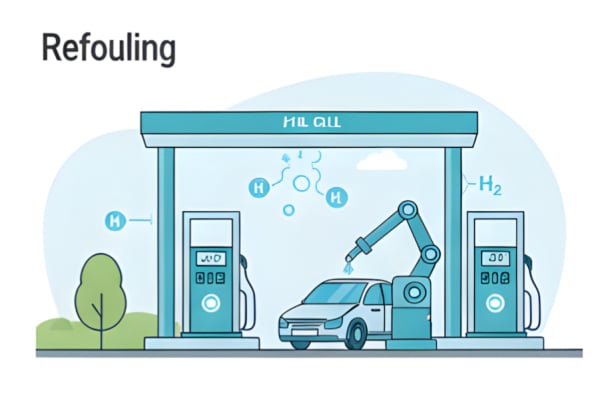

3. Hydrogen Refueling Infrastructure: Building 660 Stations by 2030

3.1 Refueling Station Status (As of May 2025)269 stations (420 units) are in operation nationwide, with 37,167 hydrogen passenger cars, 2,107 hydrogen buses, and 39 hydrogen trucks registered. The average price is KRW 10,228/kg. By region, 72 stations have been built in Gyeongsang, 53 in Chungcheong, 45 in Gyeonggi, and 38 in Honam.

The government aims to build 450 stations by 2025, 660 by 2030 (including 280 liquid hydrogen stations), and 1,200 by 2040.

3.2 Major Construction and Operation Companies

• SPV Operators

HyNet (KOGAS + Hyundai Motor)

KOHYGEN (Hyundai Motor + KDHC + 8 private companies)

H2 Station (KOGAS + Samsung C&T)

EnerHy (SK Gas + Lotte Chemical + Air Liquide)

• Oil Refining Companies

Hyundai Oilbank: Targeting 300 stations by 2040

SK E&S: 40 liquid hydrogen stations

GS Caltex: Integrated Energy Stations

3.3 Refueling Equipment Manufacturers

Compressors: Kwangshin Machine (54% share), Bumhan Fuel Cell, GTC, Daeha, Korea Hydraulic

Dispensers: MS Eng (70% localization), Hyundai Rotem, J-Eng, Samjeong E&C

Storage Vessels: Iljin Hysolus (Type IV monopoly), NK (500bar/900bar localization)

4. Hydrogen Utilization: From Mobility to Power Generation and Industry

4.1 Mobility Revolution• Hydrogen Passenger CarsHyundai Nexo is capable of driving 400km with a 180kW fuel cell and ranks first with a global market share of 29.8%.

• Hydrogen BusesAs of September 2024, 1,234 units are in operation. Hyundai Motor produced 1,281 units, and HyAxiom Motors received certification in October 2024. The government aims to deploy 21,200 units by 2030.

• Hydrogen Trucks48 units of Hyundai XCIENT have accumulated 10 million km of driving in Switzerland, saving 6,300 tons of CO2. The goal is to introduce 1,600 units in Switzerland by 2025 and 25,000 units in Europe by 2030.

• MaritimeHD Korea Shipbuilding & Offshore Engineering is scheduled to deliver the world's first medium-sized ammonia DF propulsion ship in 2025, and the ammonia DF engine has received approval from 7 global classification societies.

4.2 Power Generation: Fuel Cells and Hydrogen Co-firing• Doosan EnerbilityDeveloped a 270MW gas turbine and succeeded in demonstrating 30% hydrogen co-firing. Currently developing 50% co-firing, aiming to complete a 400MW hydrogen firing turbine by 2027. A 900MW facility (KRW 4.5 trillion) is scheduled for completion in Dangjin by 2032.

• POSCO EnergySupplied 166.7MW of MCFC (Molten Carbonate Fuel Cell) facilities to about 20 locations, achieving 47% power generation efficiency and 80% cogeneration efficiency.

• Bloom Energy KoreaBoasts the industry's highest SOFC (Solid Oxide Fuel Cell) efficiency of 53-65%, ranking first with a global share of 44%. Completed the Gumi plant in 2023 and signed a contract for up to 1GW with AEP in the US in 2024.

4.3 Industry: POSCO HyREX Hydrogen Reduction Steelmaking• HyREX TechnologyAn innovative steelmaking process using 100% hydrogen based on FINEX. Successfully produced molten iron for the first time in the world in April 2024, reducing CO2 emissions to 400kg per ton, a 78% decrease compared to the traditional method's 1,850kg.

• Schedule2026: Pilot (300,000 tons/yr)

2030: Commercial Operation (1 million tons/yr)

2050: Full Transition (100%)

• POSCO GoalPresented a vision to achieve 5 million tons of hydrogen production and KRW 30 trillion in hydrogen revenue by 2050.

4.4 Buildings: Fuel Cells for Residential and Commercial Use• S-FuelcellHolds over 50% of the domestic market share and supplies 1-50kW PEMFCs. Achieved overall efficiency of over 85% and obtained Korea's first KS certification in 2016.

The government aims to deploy 2.1GW by 2030.